WHO WE ARE

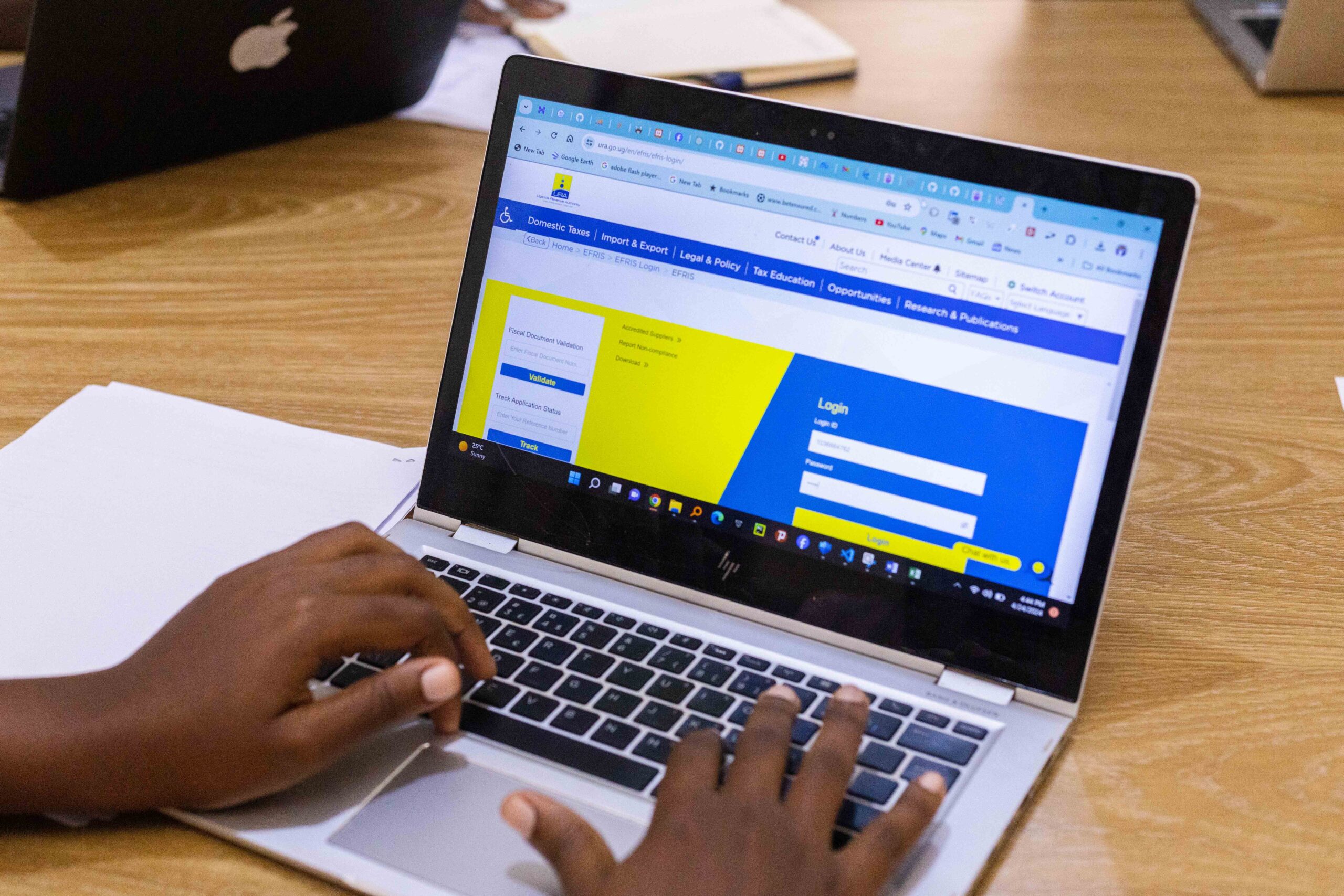

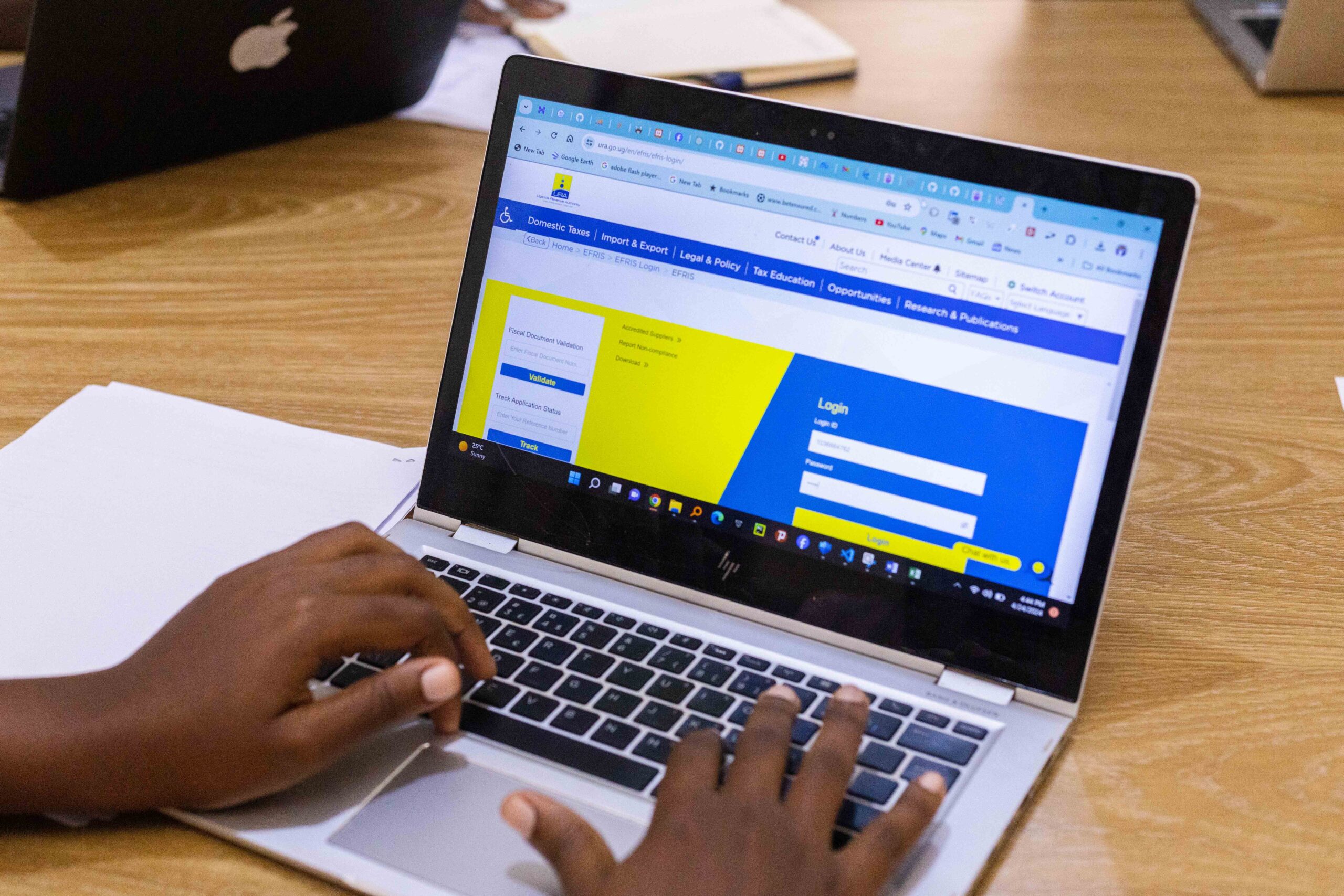

Macnitosh Tax Advisors is an accounting firm registered with the Uganda Registration Services Bureau as a private limited company and is certified by the Institute of Certified Public Accountants of Uganda. We specialize in Financial Audit, Tax and business advisory.

Macnitosh Tax Advisors is a boutique tax advisory firm dedicated to providing personalized, strategic tax solutions to individuals, families, and businesses. With a focus on proactive tax planning and compliance, the firm aims to minimize tax liabilities, optimize financial outcomes, and eliminate the stress of tax season for its clients. Headquartered in Kampala, Macnitosh Tax Advisors serves a diverse clientele, including high-net-worth individuals, small to medium-sized enterprises, and professionals seeking tailored tax strategies. We specialize in Financial Audit, Tax and business advisory.

Mission & Vision Statements

Our mission and vision statements were developed by our leadership team brainstorming together to capture the essence of our firm both today and in the future.

OUR MISSION

Macnitosh Tax Advisors is committed to provide our clients with realistic and executable solutions to complex challenges to help them make the best decisions for the successful growth and sustainability of their business and make distinctive, lasting and substantial improvements in their performance while providing a positive and motivating work environment for our employees.

OUR VISION

To build a great firm that will be known and trusted internationally for its competence and ability to help its clients achieve their business objectives through providing informed and inspired advice and services. To make it a joy for all stakeholders to work with us.

OUR VALUES

Our values define who we are. We focus on strategy, execution and operations, so that we deliver on the promise we make to our clients. We are passionate about helping our people to achieve their potential. When our people achieve their best, we can help clients achieve their best too.

Integrity

Integrity is the character of being honest and having strong moral principles; moral uprightness. It is generally a personal choice to hold oneself to consistent moral and ethical standards. Integrity also implies fair dealing and truthfulness.

Discipline

We obey the rules, regulations and laws which ensure best business practices. We have our disciplinary system and set of standard operating procedures (SOP’s). A discipline that moves under a defined set of SOP to ensure provision of high-quality services.

Professional Competence and Due Care

Macintosh Tax Advisors aims to serve clients as professionally as possible, by providing professional competence and due care. The principle of our professional competence and due care imposes professional knowledge and skill at the level required to ensure that clients or employers receive competent professional service and acting diligently in accordance with applicable technical and professional standards.

Competent professional service requires the exercise of sound judgment in applying professional knowledge and skill in the performance of such service. All consultants and employees have high levels of knowledge and competence and we transform our knowledge to our clients by providing quality professional services.

Commitment

Commitment comes to life through being passionate about solving complex business problems and helping shape the next generation of financial services. We are intensely focused on serving our clients and helping them achieve their business objectives. We do what we say we are going to do. As individuals and as an organization, we create value.

Objectivity

The principle of objectivity imposes an obligation not to compromise on professional or business judgment because of bias, conflict of interest or the undue influence of others.

A consultant may be exposed to situations that may impair objectivity. It is impracticable to define and prescribe all such situations.

Confidentiality

Our consultancy firm is committed to upholding the principle of confidentiality. We ensure that all information disclosed by prospective clients or employers remains protected. Professional accountants are obligated not to disclose or misuse confidential information obtained through professional or business relationships, unless legally or professionally required to do so.

Continuous Improvement

We measure, monitor, analyze and improve productivity, processes, tasks and ourselves to satisfy clients and stakeholders. We work with enthusiasm and intellect, and are driven to surpass what has already been achieved. We are not afraid to stand alone, especially when it is the right thing to do.

Foreword

Macnitosh Tax Advisors is committed to delivering practical, actionable solutions to complex challenges, empowering our clients to make informed decisions that drive sustainable growth and long-term success.

Our team of young, energetic professionals approaches every engagement with expertise, integrity, and a strong sense of professional ethics. We are dedicated to continuous improvement and fostering a motivating, positive work environment.

At Macnitosh, we believe that a consistent focus on quality service is the foundation for building lasting, mutually beneficial relationships with our clients.

We offer fast and reliable services in the field of income tax consultancy, auditing, accountant certification and chartered accounting services